Getting a self-employed mortgage in Toronto is never easy. However, with these 5 steps, you are a step ahead to your mortgage approval.

Being self-employed can be fulfilling. You can work at your own time, own pace, and at your own office. Whether you are working in a small room, or in a big garage, or under a big tree at the beach, the freedom is yours. Those are the benefits you’ll have for being your own boss.

However, when it comes to getting a mortgage for self-employed individuals, that’s where the challenge comes in. You may find it difficult to look for the right lender for your mortgage needs. Most Canadian banks raised their bars for self-employed lending mortgages. Passing the lender’s affordability tests seems too hard to reach. Add it up with the hassle of submitting additional documents and requirements, and you’ll wish you had a 9-5 job to get your loan application approved in a snap.

This should not be the case. Getting a mortgage when you’re self-employed is not impossible. Moreover, you don’t need to be the highest earning self-employed individual in Toronto to get issued with a loan. Getting a loan even if you are working on your own can in fact, be simple and easy. Here are five simple steps to get your mortgage application ready and have the result that you want.

Create A Plan For Your Desired Mortgage

Just like any other loans, applying for a mortgage for self-employed individuals needs thorough planning. If you want to apply for a home loan, for example, it is advisable for you to plan for it well in advance of your application. Please consult with your accountant and inform him of your plan. Make sure to keep an updated report of your quarterly and yearly income or your profit and loss statement.

List All Possible Reasons That Might Delay Your Loan Application

There will be challenges for self-employed mortgages. These challenges might affect the success of your loan application. Most mortgage lenders will require you to have an excellent credit history to approve you for a loan. Check your credit score before processing your request for a loan. To know your credit score, you can check with credit bureaus TransUnion and Equifax. If you have a lower score than the required, pay your credit cards and other lines of credit first to improve your score. Proving your income is also another challenge to get a mortgage for entrepreneurs. If at certain points of your business your income has dipped, make sure you will be able to clearly explain the figures and fluctuations.

Look for a Lender that Offers the Best Mortgage Deal For You

You may have asked yourself: Where can I get a mortgage if I am self-employed? While there are thousands of mortgage lenders in Toronto, finding the best one that suits you can be a lot of effort. But if you have a concrete plan, finding the best mortgage lender isn’t that difficult. You need to be specific about the type of mortgage that you want to apply for as well as the value of the property. Also, be specific on the amount of money that you want to borrow. Lenders would also want to know how you are going to pay off the mortgage. Therefore make sure to include the terms or timetable as to how long you want to pay the mortgage. Most lenders require a down payment of 10-35%. This is also one factor to consider so make sure to decide how much you are willing to shell out for the mortgage. Choose available lenders and check their criteria for the mortgage for self-employed that meet your mortgage plan. Look for the best rate possible, of course. Most of the lenders offer the best as long as you have given them complete information.

Ask for An Expert Advice From a Mortgage Broker

Talking to a broker first can make the whole mortgage application process more manageable. Mortgage brokers work with hundreds of mortgage lenders in Toronto. They know which lenders issue a mortgage that is best for you. They also provide you with a list of requirements that you need to submit. Mortgage brokers will also give you tips on how to get your loan application processed as quickly as possible. If you are the director of your company with retained profits, you may ask help from the mortgage broker find a lender that considers retained profits in approving your loan. There may be minimal broker fees but consulting a specialist broker also makes your loan application as stress-free as possible.

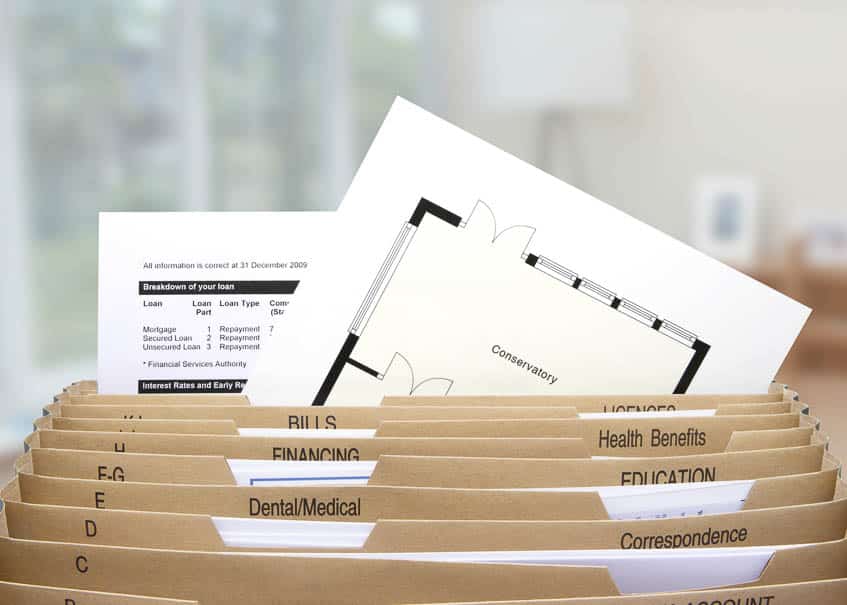

Prepare All the Necessary Documents

Self-employed mortgage lenders may require you to submit a list of requirements that are more than they would for employed individuals. As a self-employed entrepreneur, you do not have an employer to vouch for you. You cannot provide evidence for your salary and tenure of work.

Get all the documents you will need to submit to your mortgage lenders. Lenders will need to know that you have a stable source of income. They need to be assured that you can pay your mortgage off on the agreed term. Prepare your Notices of Assessment which you can get from the Canada Revenue Agency. This notice confirming that you don’t have any tax liability will add to your reliability. You also need to have your client contracts ready. This will show that you have future income coming into your business. A copy of your business license is also required as well as proof showing that you are the principal owner of your company. It would be best if you also had at least two to three years of records of your business accounts and income tax returns. Do not forget to include the details of your existing assets and outstanding debts.

I work with many entrepreneurs and have experience in getting self-employed individuals the best rate and terms through my relationships with many lenders in the Greater Toronto Area.